Right now, you’re probably thinking that’s a statement of opposites. Something dreamed up by a consultant to impress, or just to fill a blog page. But wait. What if I taught you to create order in procedural chaos in five minutes flat? ?Would you be interested then?

The first step is to create a story line ?

Let’s imagine five friends decide to row a boat across a river to an island. Mary is in charge and responsible for steering in the right direction. John on the other hand is going to do the rowing, while Sue who once watched a rowing competition will be on hand to give advice. James will sit up front so he can tell Mary when they have arrived. Finally Kevin is going to have a snooze but wants James to wake him up just before they reach the island.

That’s kind of hard to follow, isn’t it ?

Let’s see if we can make some sense of it with a basic RASCI diagram ?

| Responsibility Matrix: Rowing to the Island | |||||

| Activity | Responsible | Accountable | Supportive | Consulted | Informed |

| Person | John | Mary | Sue | James | Kevin |

| Role | Oarsman | Captain | Consultant | Navigator | Sleeper |

?

Now let’s add a simple timeline ?

| Responsibility Matrix: Rowing to the Island | |||||

| ? | Sue | John | Mary | James | Kevin |

| Gives Direction | ? | ? | A | ? | ? |

| Rows the Boat | ? | R | ? | ? | ? |

| Provides Advice | S | ? | ? | ? | ? |

| Announces Arrival | ? | ? | A | C | ? |

| Surfaces From Sleep | ? | ? | ? | C | I |

| Ties Boat to Tree | ? | ? | A | ? | ? |

?

Things are more complicated in reality ?

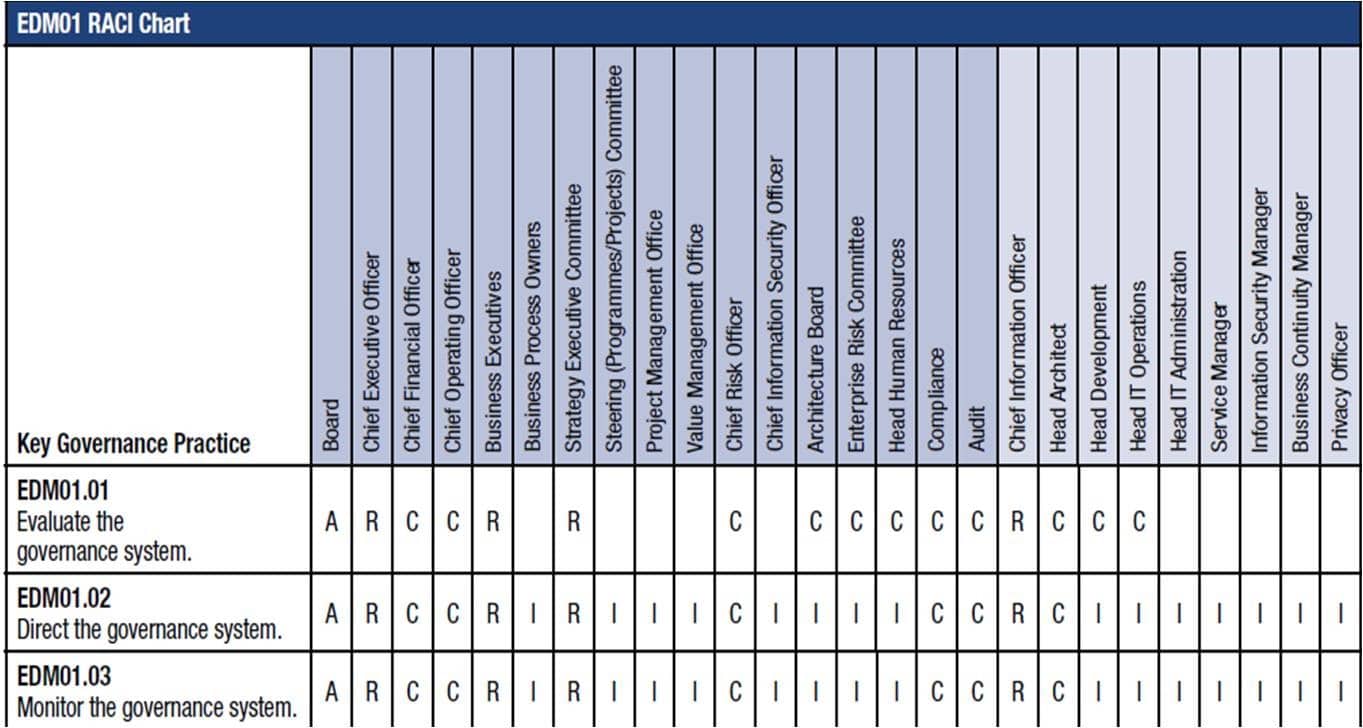

Quite correct. Although if I had jumped in at the detail end I might have lost you. Here?s a more serious example.

?

There?s absolutely no necessity for you so examine the diagram in any detail, other to note the method is even more valuable in large, corporate environments. This one is actually a RACI diagram because there are no supportive roles (which is the way the system was originally configured).

Other varieties you may come across include PACSI (perform, accountable, control, suggest, inform), and RACI-VS that adds verifier and signatory to the original mix. There are several more you can look at Wikipedia if you like.